Investment Criteria

New Construction

Renovation

Adaptive Reuse

Property and Site Criteria

New Construction

We acquire undeveloped land, then build from the ground up.

- 12,000-60,000 square feet

- Well-located for multi-family property

- Urban core

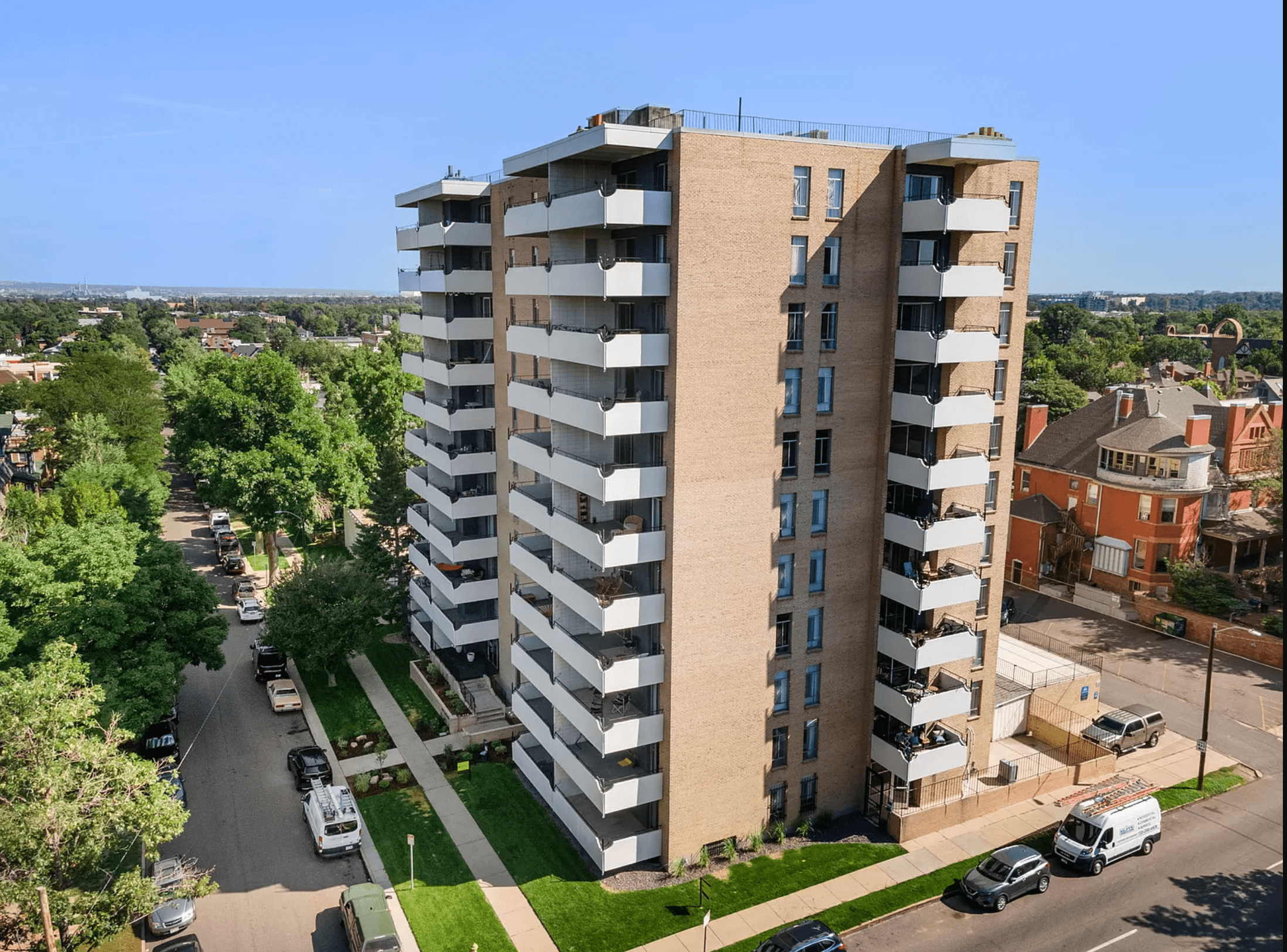

Renovation

We renovate vintage and outdated multi-family structures.

- 12-250-unit properties

- In need of medium-to-heavy value add

- Urban core

Adaptive Reuse

We acquire unique, underutilized properties prime for an adaptive reuse strategy.

- Churches

- Gas stations

- Office buildings

- Vacant retail space

- Urban core

- Other

FAQs for Property and Site Owners

What is the target demographic for JAB-acquired properties and sites?

JAB invests in attractive urban neighborhoods that cater to well-educated, upscale professionals in the 20-36-year-old age demographic.

Does JAB buy non-multi-family properties?

In zoning districts that allow multi-family development, JAB purchases vacant land and sites with non-multi-family uses that are favorable for future development.

Would JAB consider property or sites outside of its core target cities?

JAB continuously monitors several cities outside of our core investment markets, allowing us to act quickly if attractive acquisition opportunities are presented to us. Existing inventory or development sites outside of our core target cities are more than welcome as long as they fit JAB’s general investment criteria.

Is JAB a broker? Does JAB charge a brokerage fee in buying my building?

Despite the principals of JAB Real Estate being licensed brokers in the State of Illinois, we purchase the properties directly from ownership and do not charge a broker’s fee.

What should I expect as part of the acquisition process?

JAB prides itself on making the sales process as easy and non-intrusive for current ownership, management and tenants. We work with ownership to limit the disruption to the building during the sales process as to not interrupt the operation of the asset.